41+ can you write off your mortgage interest

Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations. This means your main home or your second home.

Free 41 Questionnaire Forms In Pdf Ms Word Excel

Web For you to take a home mortgage interest deduction your debt must be secured by a qualified home.

. And lets say you also paid. How Much Interest Can You Save By Increasing Your Mortgage Payment. If you use the 800 sq-ft basement.

Expert says paying off your mortgage might not be in your best financial interest. Web You can claim the mortgage interest on the portion of the home youre renting out typically determined by square footage. Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest.

A home includes a. Web Can You Write Off Mortgage Interest. At least in most circumstances you can.

Web If you took out your mortgage on or before Oct. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Homeowners who bought houses before December 16 2017 can deduct.

Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Web Most homeowners can deduct all of their mortgage interest. Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately. 13 1987 your mortgage interest is fully tax deductible without limits.

If you took out your home loan before. This means when you. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1.

The write-off is limited to interest on up to 750000 375000 for married-filing. You see in the US mortgage interest is considered tax-deductible. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction.

So lets say that you paid 10000 in mortgage interest. Web You cant deduct the principal the borrowed money youre paying back. Web The interest you pay for your mortgage can be deducted from your taxes.

In addition to itemizing these conditions must be met for mortgage interest to be deductible. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Here are 3 investments with higher yields that could essentially make your mortgage free.

Web If your home was purchased before Dec. Ad Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now. You can fully deduct home mortgage interest you pay on acquisition debt if.

Secured by that home. However if your property operates as a. Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property.

Above 109000 54500 if. Web Up to 96 cash back Used to buy build or improve your main or second home and. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Also if your mortgage balance is 750000.

Mortgage Interest Deduction Rules Limits For 2023

House Poor How To Save Money On Your Home After The Closing

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

41 Schedule Templates

Entire Ntm 2 Mb Maritime Safety Information National

Tenancy Agreement Template 41 Free Word Pdf Documents Download

House For Sale In Madhyamgram Kolkata Without Brokerage 41 House In Madhyamgram Kolkata Without Brokerage

Mortgage Interest Deduction What You Need To Know Mortgage Professional

1 Bhk House For Rent In Bannerghatta Road Bangalore 41 Single Bedroom Rental Houses In Bannerghatta Road Bangalore

Alzo8n0belei7m

Zurich Card Switzerland Klook

Handbook Of Credit Scoring By Jungpin Wu Issuu

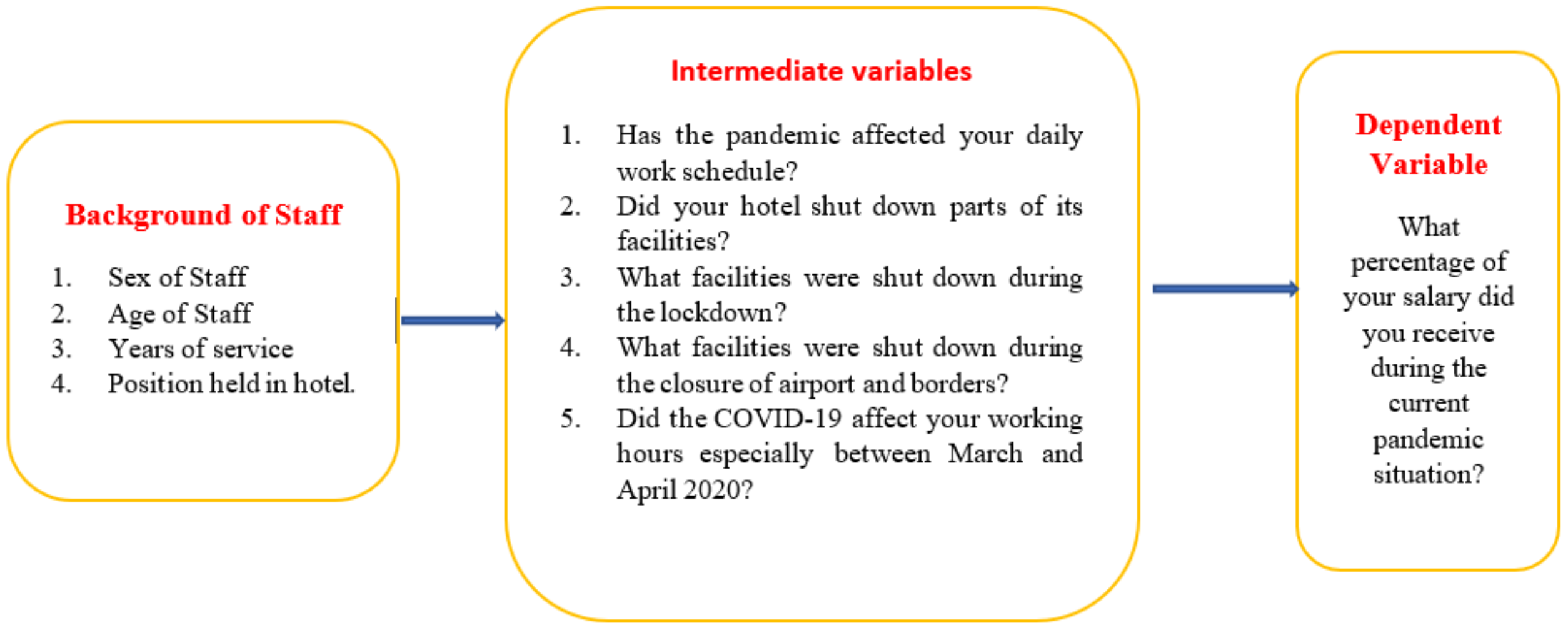

Sustainability Free Full Text Impact Of Covid 19 Pandemic On Hotel Employees In The Greater Accra Region Of Ghana

Mortgage Interest Deduction Rules Limits For 2023

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Noolnt2b8k47ym

Centrico By Windsor Apartments 8425 Nw 41st Street Doral Fl Rentcafe